Hecksher-Ohlin:

Factor Proportion Hypothesis:

Theory of endowment comparative advantage, most specifically land, labour and capital. An example of the advantage gained by this model is if you were to take two countries, in this example we will use the UK and China. China exports labour intensive goods (i.e. textiles) to the UK who in turn trade capital intensive goods (Financial market). In this way wages paid to labour in China can improve and similarly returns to capital employed improve in the UK.

In this example two market goods textiles, T, and finance, F, employ two inputs: Capital, K, and Labour, L. In which fiinance goods are more capital intensive.

(Zero profit condition)

PF = aLFw+ aKF r

PT = a LT w+ aKT r (32)

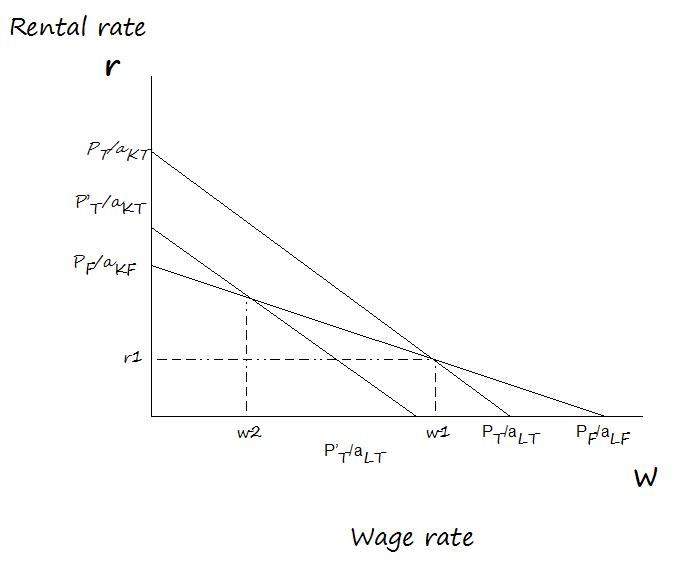

The graph below shows the effect of a drop in the price of textiles, in response to a supply shock, due to an increase in world trade. From the graph we can determine that textiles are a more labour intensive good then financial goods which are seen to be more capital intensive.

From this graph we are able to draw the conclusion that the effect of a change in price of those goods that are more labour intensive will have a greater effect on wage rate then those goods that are more capital intensive.

The Factor-proportions theory also help in explaining the disparity in wages among the skilled and unskilled labour force. This theory shows us that factors that are relatively scarce in the absence of trade will be more expensive while those that abundant will be found at a cheaper price. This theory can be applied to the labour market, where in any counrty there is a greater abundance of unskilled labour then there is skilled.

Assumptions/ Weaknesses:

The H-O model makes the following core assumptions:

- Labor and capital flow freely between sectors

- The amount of labor and capital in two countries differ (difference in endowments)

- free trade

- technology is the same across countries (long-term)

- Tastes are the same.

It assumes that all countries have access to identical technologies and are unaltered by economic activity . By assuming technology to be a given, the theory implies that trade changes wages only if it changes product prices. Other problematic areas are within countries/ industries specializing in primary raw-material production where there is a more limited growth prospect in periphery fields, this areas comparative advantage may also be lost due to the exhaustion of their export growth potential.

A lesson of which international trade has taught us is that there are often winners and losers that have come about from comparative trade. The works of economists such as R. Prebsich(1959) (22) have shown how economic growth between developed countries (DC) and less developed countries(LDC) has widened due to incomes being able to grow faster in industrialized countries then in LDC's peripherys. A country with a relative abundance of unskilled labour will have a comparative advantage in markets where the supply of cheap labour is required, this does however limit the country to a single field of comparative advantge with limited growth potential.

←Back to Main Page